- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

It’s not about what you need, it’s about what your family needs when you’re not here.

1 Million+

Families Helped

$150 Billion

Life Insurance Placed

$800 Billion

Premium Sold

10,000+

Professional Agents

It’s not about what you need, it’s about what your family needs when you’re not here.

1 Million+

Families Helped

$150 Billion

Life Insurance Placed

$800 Billion

Premium Sold

10,000+

Professional Agents

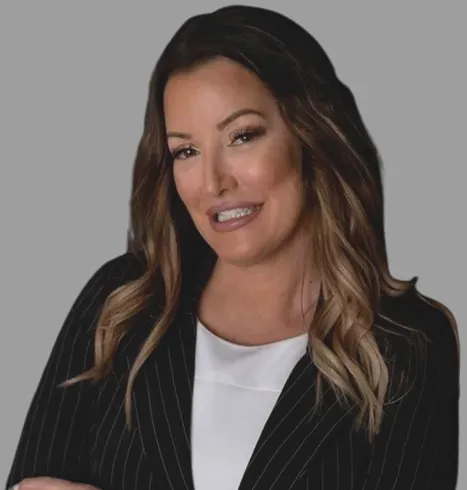

Licensed Broker & Senior Field Underwriter

ABOUT ME

ABOUT ME

Licensed Life Insurance Specialist | Field Underwriter

By designing and implementing supplemental benefit programs for businesses, I have successfully helped employers not only strengthen their overall employee benefits but also helping business owners to attract and retain quality staff.

I also design life Insurance plans specifically to my clients needs. As a life insurance specialist, I conduct a needs analysis for every client to ensure that the correct products are recommended.

I have been recognized and honored as one of the top agents nationally.

Contact me today for all your life and supplemental insurance needs.

Let me help you.

Asset Strategist. Mortgage Protection, Life Insurance and Future Planning. Protecting families for over 100 years with multiple credible carriers including Americo, CVS Health Aetna, John Hancock, Vitality, American Amicable, Mutual of Omaha, AIG, Global Atlantic, Royal Neighbors, Foresters Financial, National Life Group, Transamerica, Prosperity Life Group, Gerber, Athene and CFG.

WE GOT YOU COVERED

Final Expense

Final Expense insurance will cover you for life. Prices are locked and will never increase nor will your policy end. These types of policies are designed to make sure all funeral and other end of life expenses are covered.

Indexed Universal Life

This is a type of permanent policy that allows the insured to accumulate cash value in addition to their death benefit. It can be setup to help supplement your retirement plan.

Final Expense

Final Expense insurance will cover you for life. Prices are locked and will never increase nor will your policy end. These types of policies are designed to make sure all funeral and other end of life expenses are covered.

Indexed Universal Life

This is a type of permanent policy that allows the insured to accumulate cash value in addition to their death benefit. It can be setup to help supplement your retirement plan.

Mortgage Protection

Mortgage protection insurance is a way to protect one of your most valuable assets in the event of a death. Most terms are designed to give you a full return of premium if you outlive the policy. In the event of a death, the mortgage will be paid in full, so your family can keep the house.

Fixed Indexed Annuities

This is a safe way to participate in the market's gains while avoiding potential loses and keeping your retirement secure.

Invest In Your Future

At Family Legacy Life Insurance our trusted advisors will personally guide you through mapping out your future. From Life Insurance, Retirement Planning, Long Term Care and everything in between. Innovative thinking and sound investment decisions help you build a strong financial foundation. We’re here to help.

Protect Your Assets

Your home may be your family's largest asset and your largest financial responsibility. A Mortgage Protection Insurance policy can help your loved ones remain in the home after you're gone.

The Best Time To Qualify Is Now!

The best time to qualify for life insurance is when you are at your best! Simply put, you need life insurance if someone else is depending on your income. Usually, this means your children, but it could also be used to pay off debt for your spouse or parents.

When it comes to timing, the younger you are when you buy life insurance, the better. This is because at a younger age, you'll qualify for lower premiums. And as you get older, you could develop health problems that make insurance more expensive or even disqualify you from purchasing a plan.

Invest In Your Future

At Family Legacy Life Insurance our trusted advisors will personally guide you through mapping out your future. From Life Insurance, Retirement Planning, Long Term Care and everything in between. Innovative thinking and sound investment decisions help you build a strong financial foundation. We’re here to help.

Protect Your Assets

Your home may be your family's largest asset and your largest financial responsibility. A Mortgage Protection Insurance policy can help your loved ones remain in the home after you're gone.

The Best Time To Qualify Is Now!

The best time to qualify for life insurance is when you are at your best! Simply put, you need life insurance if someone else is depending on your income. Usually, this means your children, but it could also be used to pay off debt for your spouse or parents.

When it comes to timing, the younger you are when you buy life insurance, the better. This is because at a younger age, you'll qualify for lower premiums. And as you get older, you could develop health problems that make insurance more expensive or even disqualify you from purchasing a plan.

Licenses & Credentials

National Producer #: 6441391

Industry's Best

Insurance Providers

Request a quote

Request a quote

Just fill out the form with your contact information and we’ll get back to you as soon as possible.

Just fill out the form with your contact information and we’ll get back to you as soon as possible.

We respect your privacy.

© Copyright 2022. Verified Producer. All rights reserved.